Metechi

Designing the Foundation of a Financial Marketplace

00

problem

Metechi set out to build a modern marketplace for commercial real estate loans, connecting banks, brokers, and institutional investors inside a single digital system. The ambition was high, but the constraints were severe. Financial marketplaces operate under heavy regulation, strict compliance requirements, and zero tolerance for ambiguity. Any UX mistake could undermine trust immediately. The platform needed to support multiple user groups with different permissions, risk profiles, and responsibilities. Sensitive financial data required precise access control. Complex legal and approval workflows had to be embedded directly into the product. The challenge was not just building a marketplace, but designing trust into every interaction from the first screen onward.

solution

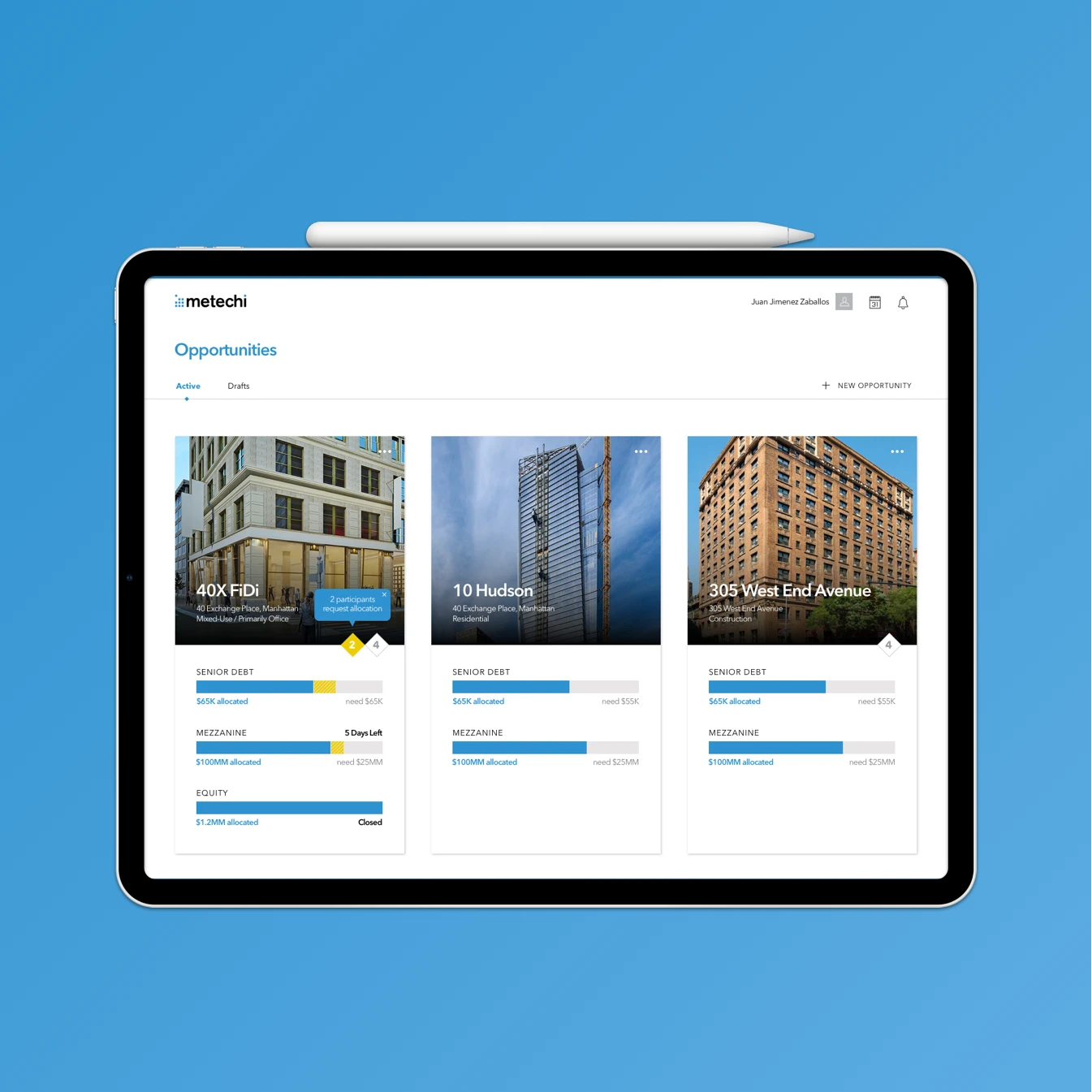

I supported design of Metechi’s first MVP as a structured workflow system rather than a traditional marketplace. Instead of exposing deals and actions all at once, the platform was built around sequential, role based flows that mirrored how capital actually moves between institutions. The goal was clarity and predictability. Every user needed to know exactly what they could see, what they could do, and what would happen next. By prioritizing structure over novelty, the product could support real financial activity from day one and establish a foundation strong enough to scale.

Before designing interfaces, I immersed myself in how commercial real estate loans are originated, syndicated, and acquired. I mapped the journeys of bank originators, brokers, investors, and loan buyers and sellers. Across every conversation, the same issue surfaced. The process was fragmented, opaque, and overloaded with manual documentation.

Designing trust through sequence

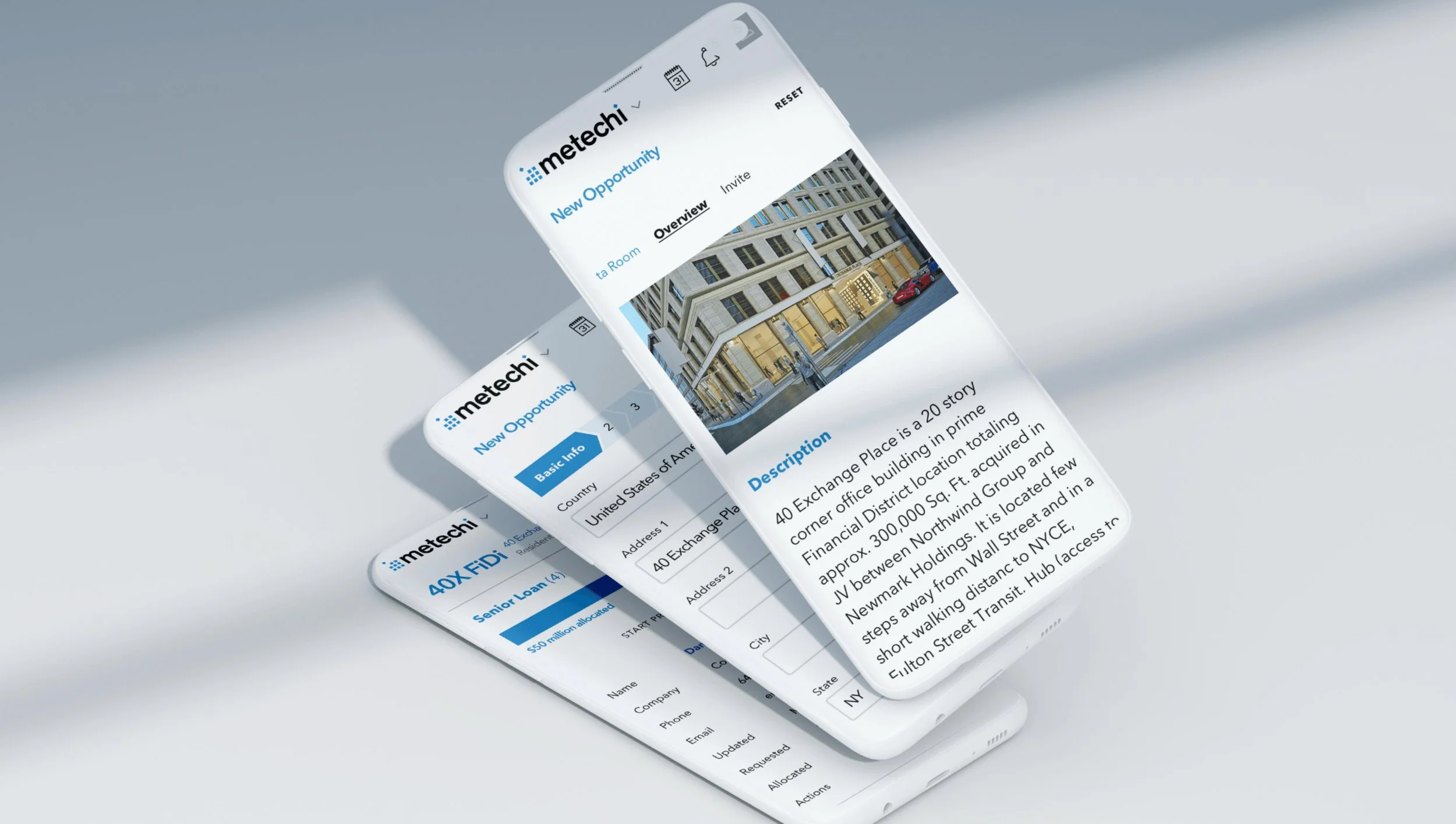

The key breakthrough was reframing the platform as a guided process rather than an open marketplace. I designed the system around role based visibility, document trails, approval checkpoints, and transparent status updates. Nothing was ambiguous. Users always knew where a deal stood, who needed to act next, and why.

This structure allowed complex actions like posting deals, reviewing documentation, submitting bids, and approving participation to unfold in a controlled, auditable way.

Information architecture

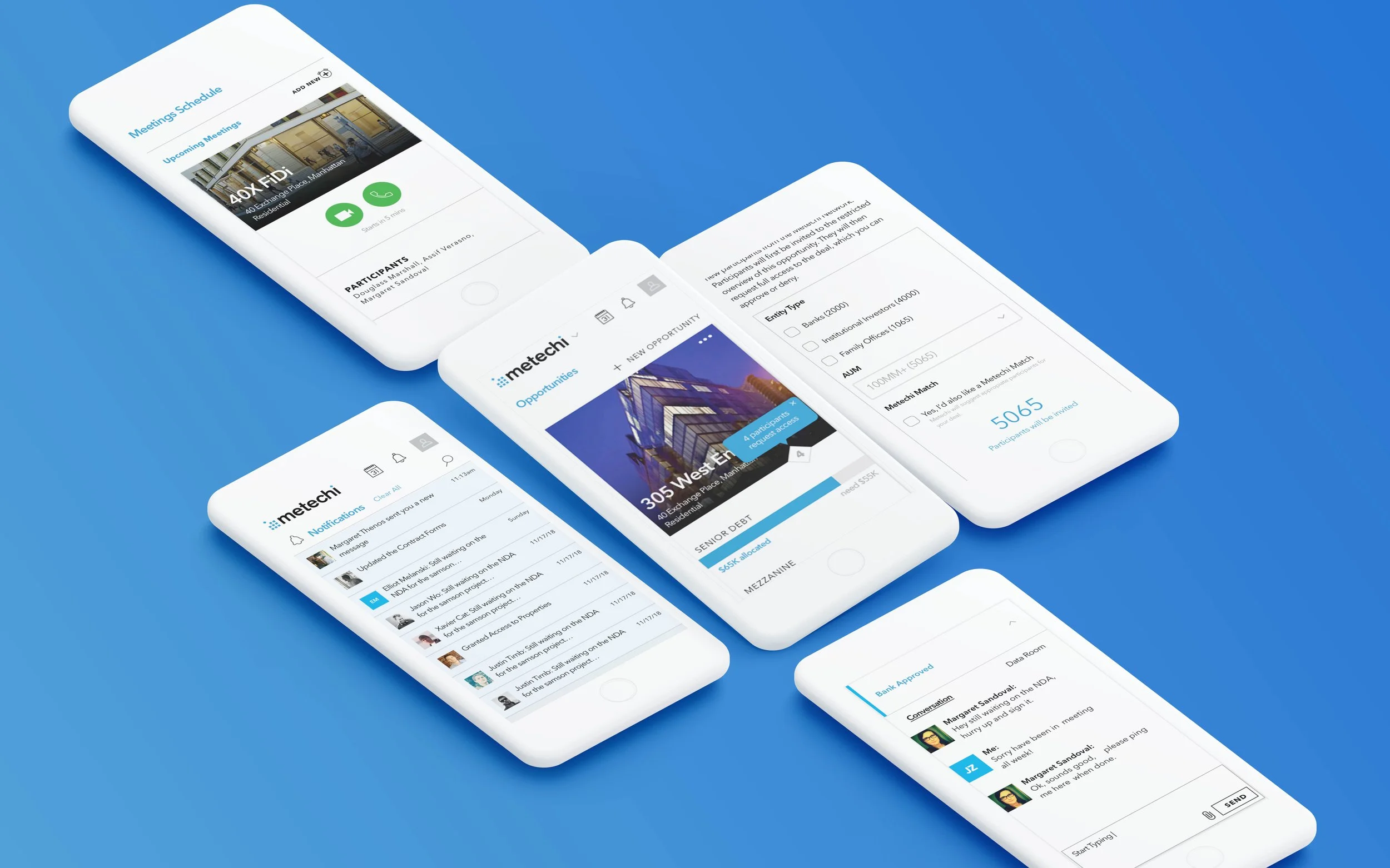

The product architecture was designed to be modular and resilient. Core activities such as loan posting, deal review, document exchange, bidding, approvals, and transaction tracking were separated into clear functional areas. This ensured that new features could be added over time without destabilizing the system.

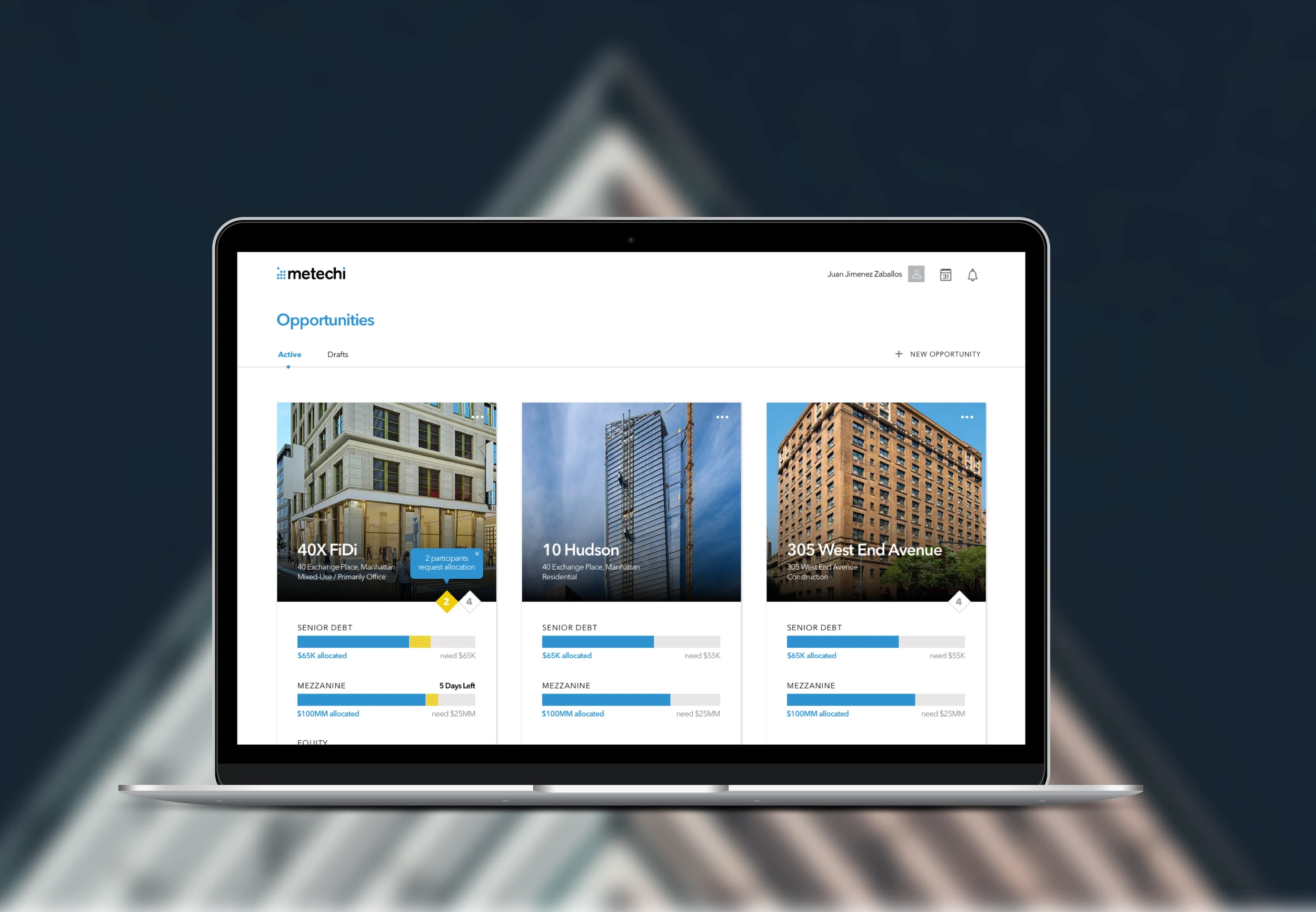

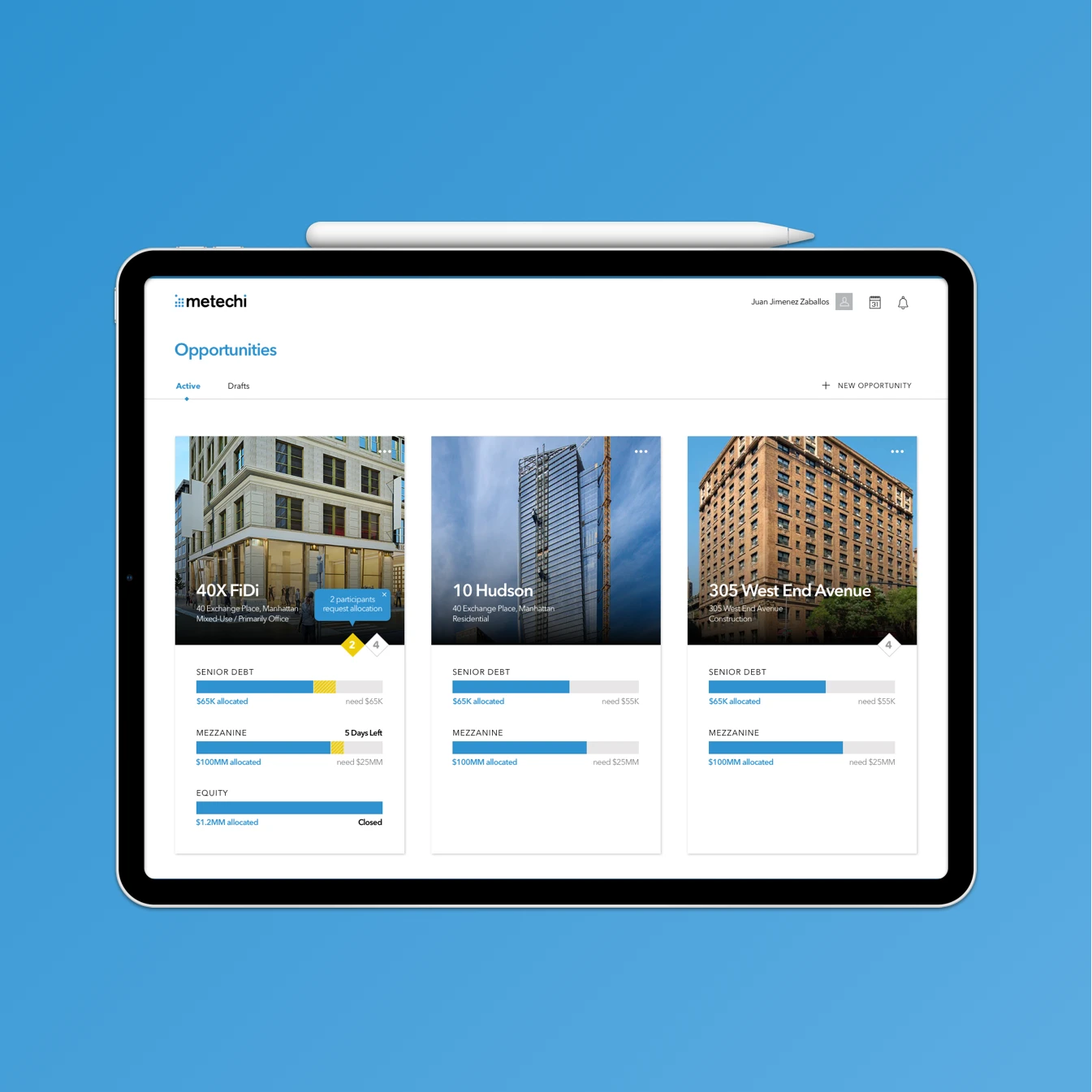

UX and dashboards

User flows were documented in detail to align business logic with interface behavior. Dashboards were designed so each user type only saw what was relevant to their role. There was no noise and no unnecessary data. The focus was on actionable information and clear next steps.

Iteration and validation

To reduce risk, the product was built in small, validated increments. Each segment went through its own prototype, review, and approval cycle before moving forward. This approach maintained accuracy, controlled complexity, and kept stakeholders aligned throughout the build.

Outcome

Metechi launched its MVP within six months. The platform went on to support over one billion dollars in active assets and played a key role in enabling a five million dollar fundraising round. Banks, brokers, and investors were able to use the system with confidence from day one.

The MVP became the operational backbone of the company, enabling growth, scale, and future iterations without needing to rebuild the foundation.

Reflection

This project reinforced a core belief in my work. In complex systems, design is not about simplification through reduction. It is about precision through structure. When workflows are clear, permissions are explicit, and sequencing is intentional, trust follows.

Metechi’s early product did not just validate a business idea. It demonstrated that even the most regulated, high stakes systems can be transformed through thoughtful, disciplined design.

01

02

03

04

05

see also